As the 2024 election season heats up, many Americans are closely watching not just the political landscape but also the housing market. The intersection of these two critical areas of life can present unique opportunities for both homebuyers and sellers. Here’s why now might be an ideal time to consider making a move in the real estate market.

Political Uncertainty and Market Stability

Elections often bring a degree of uncertainty, which can affect various sectors of the economy, including real estate. This uncertainty can also lead to stability in housing prices as both buyers and sellers hesitate, waiting to see the outcome of the election. This hesitation can result in a more balanced market, where neither buyers nor sellers hold a significant advantage, potentially making it an excellent time for transactions.

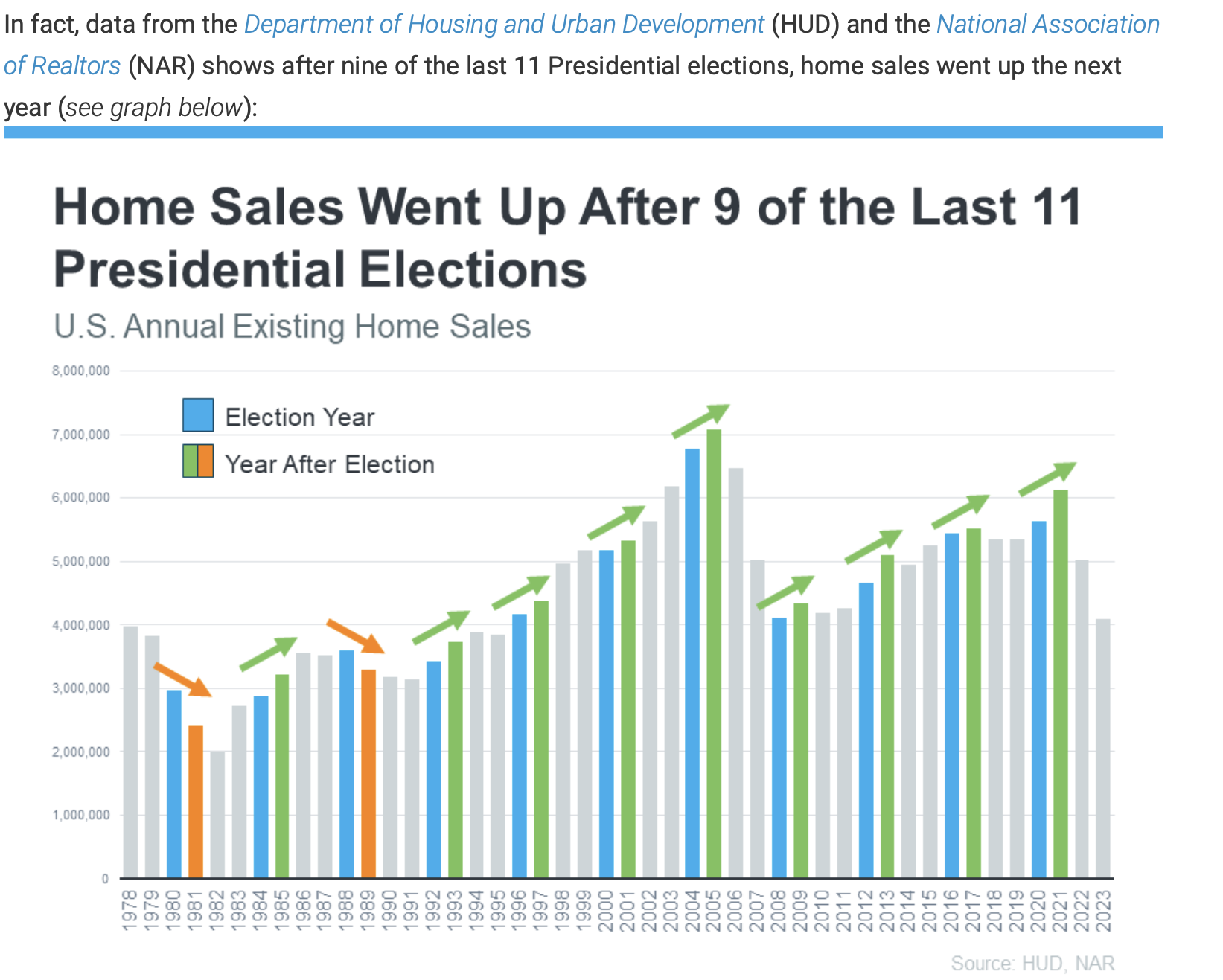

Source HUD, NAR

Interest Rates and Economic Policy

Interest rates play a crucial role in the affordability of home purchases. The Federal Reserve’s monetary policy, often influenced by the current administration’s economic outlook, can lead to adjustments in interest rates. As of now, interest rates remain relatively low, providing favorable conditions for buyers to secure affordable mortgages. Prospective buyers might want to act quickly before any post-election economic policies potentially lead to higher rates.

How Interest Rates Influence Monthly Costs

Interest rates directly affect the monthly mortgage payments for homebuyers. A lower interest rate reduces the amount of interest paid over the life of the loan, thus lowering monthly payments. Conversely, higher interest rates increase monthly costs. Here’s an example to illustrate this:

- Loan Amount: $300,000

- Loan Term: 30 years

| Interest Rate | Monthly Payment |

|---|---|

| 3% | $1,265 |

| 4% | $1,432 |

| 5% | $1,610 |

Even a 1% increase in interest rates can significantly impact monthly payments, making homes less affordable for many buyers. Therefore, locking in a low interest rate can lead to substantial savings over the course of a mortgage(www.nar.realtor) (Statista).

Inventory Levels and Market Dynamics

The housing market has experienced fluctuating inventory levels over the past few years. Currently, there is a notable balance between supply and demand. This equilibrium can make it easier for buyers to find a home that meets their needs without the intense competition seen in a seller’s market. For sellers, this balanced market means there are still plenty of motivated buyers, but without the pressure to dramatically underprice or overprice properties.

Consumer Confidence and Spending

Elections can significantly impact consumer confidence. As election day approaches, confidence can waver, but historically, it tends to rebound once the outcome is known, regardless of the result. High consumer confidence post-election can boost the housing market, making it a favorable time for sellers to list their homes, knowing that buyers may feel more secure in making large financial commitments. Additionally, with buyer demand potentially increasing, sellers may raise prices, capitalizing on the heightened interest.

Locking in Lower Mortgage Rates and Housing Prices

Buyers who lock in a lower mortgage rate before the election, while housing prices are still reasonable, can save significantly over the long term. This strategy is particularly beneficial as housing prices may rise with increased buyer demand. The National Association of Realtors has documented that after the last 9 of 11 Presidential elections, home prices went up after the election.

Here’s where a knowledgeable real estate agent becomes invaluable—they can help you navigate the market, find the right home, and negotiate the best deal, ensuring you secure a property at a favorable price and interest rate.

Tax Implications and Housing Policy

Election outcomes can lead to changes in tax policies and housing regulations. Potential changes to property tax laws, mortgage interest deductions, and other housing-related policies can influence the market. Buyers and sellers who act before any new policies are implemented can take advantage of the current tax environment, avoiding potential unfavorable changes.

Strategic Timing

Timing is always a crucial factor in real estate. With the election causing a temporary slowdown in market activity, savvy buyers and sellers can use this period to negotiate better deals. Buyers might find sellers more willing to negotiate on price or terms to secure a sale before any potential market shifts. Sellers, on the other hand, can capitalize on motivated buyers who are eager to lock in low mortgage rates before any economic changes post-election.

Conclusion

The 2024 election is set to bring changes and uncertainties, but these can also present unique opportunities in the housing market. Whether you’re looking to buy your first home, upgrade to a larger property, or sell your current residence, understanding the interplay between political events and market conditions can help you make informed decisions. Now may indeed be a strategically advantageous time to make your move in the real estate market.

Contact me today so we can start your search for a great real estate deal!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link