Buying a home is a significant milestone in life, often symbolizing stability, achievement, and a place to call your own. However, the journey to homeownership can also be fraught with fears and uncertainties. From financial concerns to the complexities of the process itself, these fears can be daunting. Yet, with proper knowledge and preparation, you can navigate these challenges confidently. Here’s a look at some common fears associated with buying a home and practical strategies to overcome them:

1. Fear of Financial Burden

Fear: Many prospective buyers worry about the financial responsibilities that come with homeownership. From mortgage payments to maintenance costs and property taxes, the financial commitment can seem overwhelming.

Strategy:

- Create a Budget: Start by assessing your financial situation and determining how much you can comfortably afford to spend on a home. Use online calculators to estimate mortgage payments and factor in additional costs like utilities and insurance.

- Build an Emergency Fund: Having savings set aside for unexpected repairs or financial downturns can provide peace of mind. Think about contingency savings as well. Get in the groove of saving money, this step helps a lot.

- Talk to a Financial Advisor: Seek guidance from a financial advisor who can help you understand your options and develop a plan to manage expenses effectively.

2. Fear of the Buying Process

Fear: The process of buying a home involves multiple steps, from finding the right property to negotiating terms and completing paperwork. For first-time buyers, the complexity of the process can be intimidating.

Strategy:

- Educate Yourself: Research the home-buying process thoroughly. Understand each step involved, from getting pre-approved for a mortgage to closing the deal.

- Work with a Real Estate Agent: A qualified real estate agent can guide you through the process, providing expertise and support at every stage. This is what a real estate agent is for, to guide your through the complexities of a real estate transaction. Use this valuable resource, especially as a first time homebuyer.

- Ask Questions: Don’t hesitate to ask questions and seek clarification from your agent, lender, or legal advisor. Understanding the process can alleviate anxieties.

3. Fear of Making the Wrong Decision

Fear: The fear of buyer’s remorse is common among prospective homeowners, and it does happen but it is not the end of the world. Making such a significant financial and personal investment can lead to worries about choosing the wrong property or neighborhood. There are a lot of fantastic properties on the market at any given time. You most likely will not buy just one home in your lifetime so enjoy the process and learn from each purchase so you can find your long term dream home, and make some money along the way.

Strategy:

- Define Your Needs and Wants: Prioritize what you’re looking for in a home, such as location, size, amenities, and future resale value. This clarity can help you make informed decisions.

- Research Neighborhoods: Explore different neighborhoods to find the one that aligns with your lifestyle and long-term goals.

- Attend Open Houses: Take advantage of open houses to get a feel for different properties and gather insights from current homeowners in the area.

- Equity Building Strategy: Go into the real estate market with an equity building strategy in mind. Your first home may not be your dream home, but if you maintain it, do upgrades when possible, and hold the home for a growth period you can earn a profit and step up to the next wonderful home. Keep building off this strategy on your real estate journey.

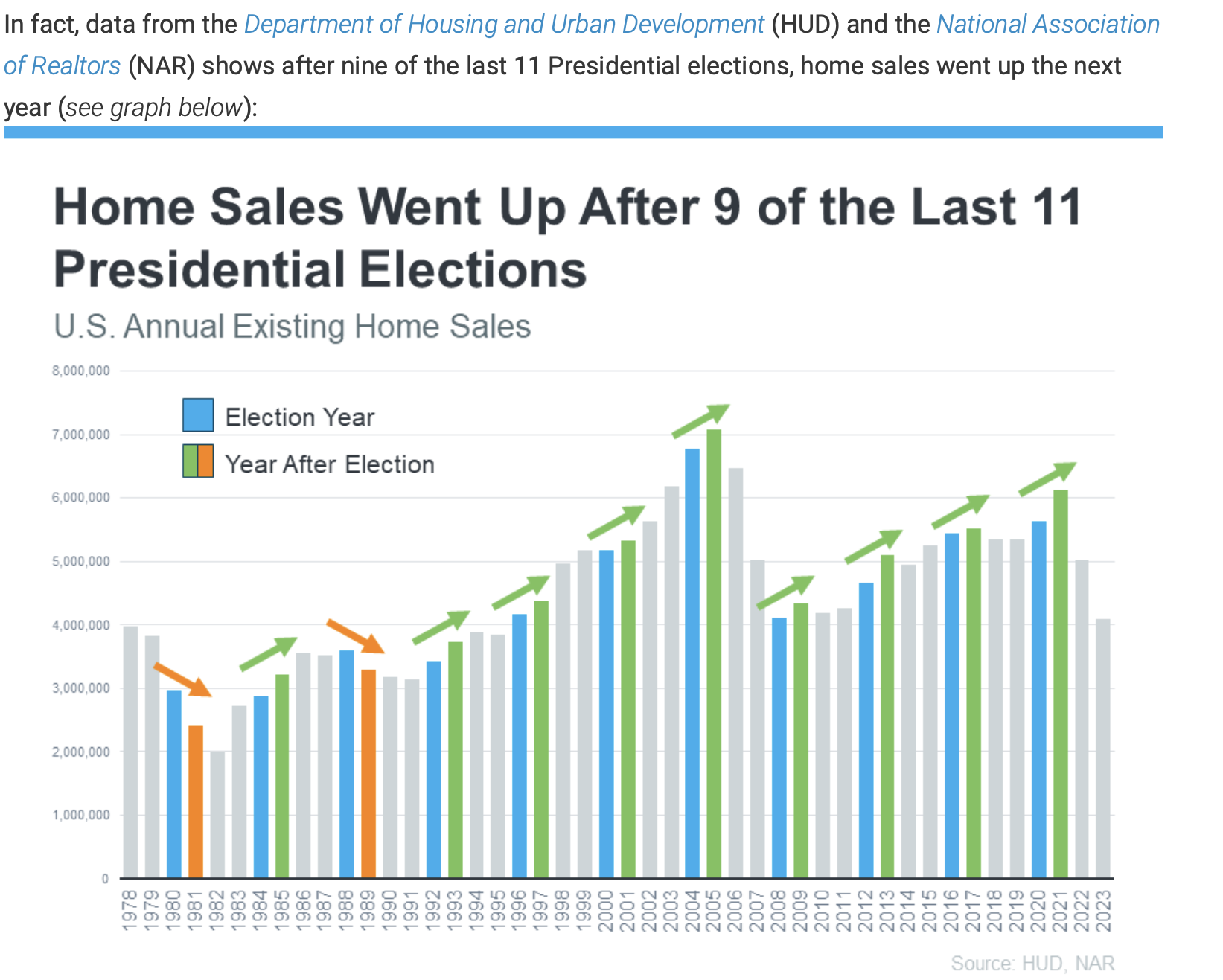

4. Fear of the Real Estate Market

Fear: Fluctuations in the real estate market can create uncertainty for buyers. Concerns about market conditions, such as rising prices or economic instability, may deter potential buyers from making a purchase.

Strategy:

- Stay Informed: Keep abreast of market trends and conditions in your desired location. Understanding market dynamics can help you make strategic decisions.

- Be Flexible: Consider timing your purchase based on market conditions or exploring different neighborhoods that offer better value.

- Consult Professionals: Real estate agents and market analysts can provide valuable insights into local market trends and forecasts.

Source HUD, NAR

5. Fear of Commitment

Fear: Committing to a mortgage and long-term homeownership can feel like a daunting commitment, especially for individuals accustomed to renting or moving frequently.

Strategy:

- Evaluate Your Long-Term Goals: Consider how homeownership aligns with your personal and financial goals. Assess whether buying a home fits into your long-term plans.

- Start Small: If unsure about long-term commitment, explore starter homes or condominiums that offer flexibility and lower financial obligations.

- Rent vs. Buy Analysis: Compare the costs and benefits of renting versus buying in your current situation. Sometimes renting may be a better short-term option while you save more or wait for market conditions to improve.

Additional Strategies

Finding a Home in Your Price Range:

- Get Pre-Approved: Before you start house hunting, get pre-approved for a mortgage. This will give you a clear understanding of your budget and strengthen your position as a serious buyer.

- Consider Starter Homes: Starter homes are typically more affordable and can be a great option for building equity. Look for properties that have potential for appreciation with minor renovations or improvements.

- Explore Different Neighborhoods: Expand your search to include up-and-coming neighborhoods or areas slightly outside your initial target zone. You might find better value for your budget without compromising on quality of life.

Building Equity with a Starter Home:

- Invest in Renovations: Focus on renovations that add value, such as kitchen upgrades, bathroom remodels, or energy-efficient improvements. These enhancements can increase your home’s resale value over time.

- Monitor Market Trends: Keep an eye on local market trends and economic forecasts. Understanding the potential for appreciation in your chosen neighborhood can help you make informed decisions about when to sell or upgrade.

- Consult Real Estate Professionals: Work closely with a real estate agent who specializes in your target market. They can provide insights into property values, neighborhood dynamics, and future development plans that may affect your investment.

Conclusion

Navigating the fears associated with buying a home requires preparation, knowledge, and a proactive approach. By addressing financial concerns, educating yourself about the process, understanding market dynamics, and exploring affordable housing options, you can confidently embark on the path to homeownership. Remember, each step you take brings you closer to achieving your goal of owning a home that fits your lifestyle and financial aspirations. Embrace the journey with confidence, and soon you’ll find yourself settling into a place you proudly call home.

Contact me today for more information about buying a home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link